I had added 2 accounts from another bank to EB, then later decided not to use EB with them. I then deleted them and I think the funds went to Unallocated.

Do the funds stay in unallocated? When I created the accounts with new Income, is there a way to remove the funds from unallocated when the accounts are deleted so that unallocated is back in line?

This is important to me as I am still trying to find a wsy to determine how much extra money us available to spend. The community has been very helpful trying to guide me thru this but I just feel like I’m missing some things.

Are you sure the balance went into Unallocated? I just tried it with a dummy account and deleting the account just reduced the Unallocated balance by that much. If you just delete the account outright I thought it removed it from your Unallocated balance as well?

Thanks Tiffany,

I am not really sure. It was several weeks ago, but that is my memory. I am still dealing with the same question as before which you have been so helpful to me with, “How much money do I have that is available to spend.” One of these days all of this will come together for me and cohabit with my managerial accounting, and I will be more at peace.

Tiffany, for the record I checked the listing of transactions for unallocated and it shows the 2 deleted accounts as deleted with black amounts equalling the balances in the deleted accounts, so that would be subtracting from unallocated as I see it.

I feel like, with your background, you’re going to have a lightbulb moment when it all clicks into place!

To oversimplify, the amount you have available to spend is whatever is still in your envelopes, plus any Unallocated money you won’t need for your next Fill. You’ll need to be sure you have envelopes for any money you DON’T want to spend so it won’t show as unallocated (savings accounts, etc.)

Here are three different scenarios based on a $500/month total budget:

Scenario 1) On May 1 I had $550 so I filled my 5 envelopes with $100 each, my monthly budget. That left $50 in my Unallocated envelope toward next month’s fill. Today we’re halfway through the month. I still have $100 unspent in one envelope, $50 in another, and $25 in each of the other three. I also received a paycheck of $200 that I left Unallocated, so that balance today is $250 (but I’ll need $500 next month to fill all my envelopes at once, so I should leave that alone).

That means I have $225 left to spend because that’s what’s in my envelopes, and the unallocated money will be needed next month. Some people make an envelope just for next month’s buffer so they can start filling every envelope at once on the first, but if you’re not there it’s fine and you can just fill them up along the way. (Goodbudget has a nice video that explains how to start working toward that goal!)

Scenario 2) On May 1 I had $1,000 so I filled my 5 envelopes with $100 each, my monthly budget. That left $500 in my Unallocated envelope toward next month’s fill. Today we’re halfway through the month. I still have $100 unspent in one envelope, $50 in another, and $25 in each of the other three. I also received a paycheck of $200 that I left Unallocated, so that balance today is $700 (but I’ll need $500 next month to fill all my envelopes at once, so I should leave SOME OF that alone).

That means I have $225 left to spend in my envelopes, but if I ALSO chose to move some money from Unallocated to an envelope to use this month it would be safe because I still have more than enough for next month.

Scenario 3) On May 1 I had $300 which isn’t enough to fill all my envelopes. I went ahead and filled my three “necessity” envelopes with enough to get me to my next paycheck, but I’m still $200 short of my budget overall. When I received a paycheck of $200 I added it to the envelopes so that I’d have enough to get through the month, and when I get paid again it will go into Unallocated to help me get a jump on next month. Today we’re halfway through the month. I still have $100 unspent in one envelope, $50 in another, and $25 in each of the other three.

That means I have $225 left to spend NOW because that’s what’s in my envelopes, and the unallocated money will be needed next month, but for a while I could only spend whatever money was left in the partially filled envelopes without risking an overdrawn account.

I hope this didn’t confuse things even more, but I think pretty much everyone can relate to one of those situations (and maybe different ones in different months!) Hope that helps!

Tiffany, thank you again your scenarios are helpful

Where my block comes in is this: I have a checking account, a savings account and a credit card. All three of these have been reconciled and match the bank. Being a nitpicker I want to make sure that the envelopes really represent actual money in the bank. You mentioned before that the envelopes are different but equal to the accounts, and I wanted a way to check it out’

My budget adds its own complications as I have income coming in at two different times of the month. So I can keep it straight the month’s second income I pair up with my envelope fill. I use my entire monthly income (the sum of both incomes) which I fill in my envelopes putting my unbudgeted portion into two envelopes (“unassigned” and “for savings”).

The bottom line is I think that I may have filled envelopes with too much money so I am trying to find a way of determining 1) if that is true, and 2) if so, by how much. I can then adjust the envelopes accordingly. The multitude of transactions in and out muddies the water for me. I just want to make sure that I am not going to have a big “reckoning” one day.

Tiffany, I appreciate you letting me talk my way through this, as this has really got me going.

I’m happy to help! In the scenario you’ve just described, the one question I have is whether you have a balance on your credit card or whether it’s paid off monthly–but I’ll tell you how I’d manage it either way.

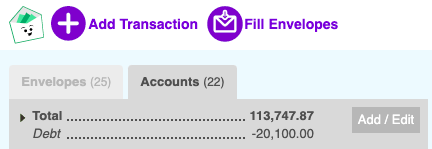

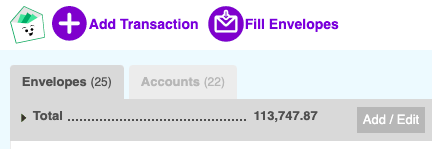

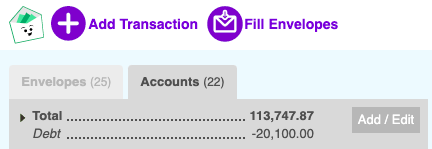

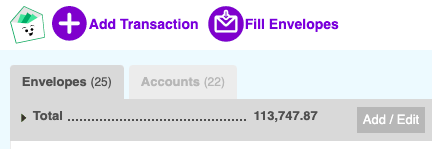

If you pay off your credit card monthly, you don’t need to represent it any differently in your envelopes. You’d make sure you have one envelope that matches your ENTIRE savings account (that way the savings money is accounted for and not “spendable”) but the other envelopes would be “regular” budget envelopes. The total in your accounts will equal the total remaining in all your envelopes and you can view these at the very top of each tab if you’re working on the web version. If you also have debts like loans, that total won’t be counted toward or against your available money but any balances on credit cards you pay off monthly will be deducted from your available funds.

If you do carry a balance on a credit card, the only difference is that you’ll need to budget for some money to pay toward the balance and interest, in addition to the new charges you’ve recorded in regular budget envelopes. Say I’m working to pay off $1,000 on a credit card, but I still use it occasionally. I might budget $75/month in an envelope JUST for paying off the card, but if I used it to buy dinner I would record that transaction in the Dining Out envelope. When the bill comes, I would pay 100% of the new charges PLUS the amount in my “payoff” envelope to help bring the balance down. This would all be captured in envelopes.

So, long story short: if you have an envelope that equals all of your savings, and one for any additional money you want to pay toward existing debts, the remainder should be available to spend or save whether you use it at the beginning of the month or fill your envelopes with your second income.

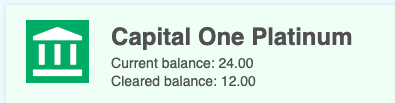

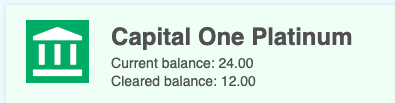

Personally, I do my reckoning at the very end of the month so I know I’m starting fresh on the first. (I do reconcile my accounts to statements too of course!) On the last day of the month, I try to make sure there are no transactions yet to be recorded in Goodbudget and that my “Cleared Balance” in each account matches between the bank/credit card and my Goodbudget ledger.

That may be even more work than you’d like to take on but I kind of enjoy it (I’m such a nerd!) and if you just do it one time and regularly reconcile against your statements, you won’t likely ever have a big reckoning to surprise you.

I hope this is helpful–sorry I get so long-winded!

1 Like

Thanks again Tiffany. I don’t mind the long-winded because I learn more about the program.

1 Like

Hurrah!!! Tiffany, the lightbulb lit up.

It became understandable as all income goes into envelopes with available to allocate in its own to folders “unassigned” and “savings hold”. When everything is correct the unallocated actually equals my savings account.

2 Likes