Hi! Newbie here completely confused about the difference between Accounts, Credit Cards and Debts as they relate to tracking interest expense.

It seems logical to me that there should be a way to see the total interest we’re paying but we experimented with setting up credit card and debt accounts and recording payments — we can’t even figure out where, if anywhere - the interest is being tracked and there doesn’t seem to be any way to build a report on it or export it.

So it seems like the only way to do that is to set up a debt / credit card as an account (with a negative balance) then create an envelope for Interest Paid to serve as a home for the finance charges?

Any advantage in using Credit Cards vs. Accounts for this? And how are the Debts intended to be used?

There are two ways to set up a credit card; first, as a “pay off every month” account (thus no interest accrues) or as a “working to pay off” account. If you choose the latter, you’ll have the opportunity to enter interest with each payment, and the account screen will show you how much you’ve paid since you started tracking. Adding charges to those accounts AND using budget envelopes can be sticky, so it’s best to simply work to pay them off vs. trying to use them and pay them at the same time. (It can be done, but it takes some fancy footwork and a couple of workarounds to get there)

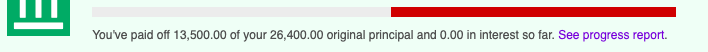

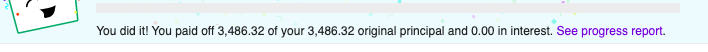

This is a zero-interest loan we’re paying off:

And here’s a credit card we paid off (also with no interest, so that’s not a glitch):

If you were to set up your debt/credit card as a regular account with a negative balance, then your Unallocated money and monthly totals would be off because it would assume that’s part of your working budget and that you’re hopelessly overdrawn. Debts aren’t calculated that way, so it’s better to set them up as debts/credit cards in order to make your budgeting meaningful.

Does that help?

This helps explain what GoodBudget is doing but doesn’t solve the problem of keeping track of total interest paid per month.

Here’s what does seem to be working:

- Set up every loan / credit card as a “Credit Card - Pay In Full”

- Enter finance charges as expenses to an “Interest Charges” envelope either when charged (cc) or when payment is made (loan)

- Set up an offsetting credit card account with a credit balance that offsets the amount of our pre-existing credit card debt so that it doesn’t distort our working balances.

My hypothesis is that I will be able to make an adjusting entry that will update the balance of the offset account to zero out the credit cards on the 1st of the month, and then the credit card balance will track our actual credit card spending that month (i.e. the amount we need to pay at minimum to stay even).

When I do this, the credit card balances reflect what we’ve spent on our cards and everything else seems to work as expected.

And I’ll be able to keep track of total interest spent servicing the debt and watch it go down as the balance in that offsetting account also goes down.

1 Like

Accounts = Assets, i.e. savings and checking. Add interest as a credit or income.

Credit Cards = liabilities, just as one would think a credit card is. Add interest as a charge.

Debt = only used for loans, money received from a lender at one time, and paid down over time. This has a built-in function to handle interest, which I haven’t been too pleased with.

As for credit cards, I always set them up as pay off every month, even if I do occasionally carry a balance for several months or so. It doesn’t happen often, but it does happen. I record the interest as a charge with the Payee as “Interest” and the interest is charged to the envelope that the original charge was for. For example, I have a large vehicle repair that I decide to payoff over a three month period. The original charge will go towards Vehicle: Repairs. The interest that’s on each month’s statement will go against the Vehicle: Repairs envelope also, since that will be the true cost of the repair. However, the interest can go against any envelope you want. But it doesn’t need to go into a separate Interest envelope if the purpose of that envelope is just to track interest. It’s easy to see the total interest by running a Spending By Payee report on the credit card and view the “Interest” payee in the report.

I’ve been using this method in GB for years now and it’s worked flawlessly for me. However, there are many different ways to manage finances in GB and you will definitely find that out here by other forum users. So, listening to other users here, with the different ways something can be done, you’ll find a way that’s comfortable and makes sense to you.

1 Like

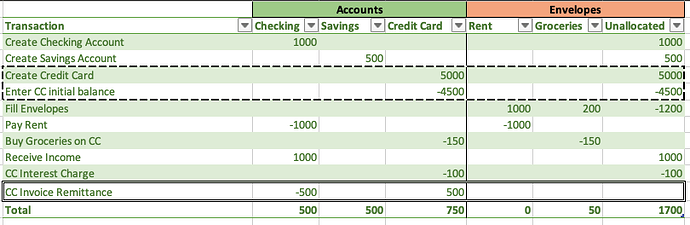

Here’s another idea I’ve been working on for managing a line of credit as an asset rather than as a liability:

Long story short, you simply add the credit limit like any other money you have as an account and your Unallocated will increase to match. Then you can record an initial balance if you have one, use the CC to pay for expenses, record interest charges when you receive the statement, and simply make a payment as an Account Transfer from Checking to Credit Card.

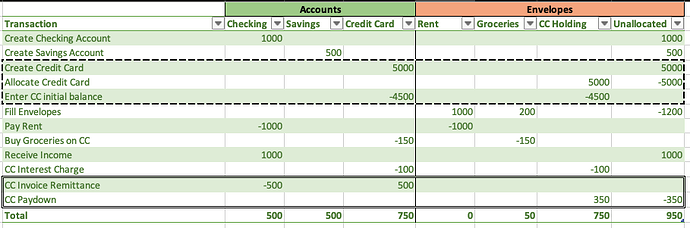

Some people don’t like this idea and would rather have Unallocated only reflect the actual liquid money in the bank or in cash. That’s a little trickier to do in GB and I have been working on the idea for a while. It’s not perfect but getting closer:

The idea here is that we add a Goal envelope (with no due date) as a kind of “holding tank” for the credit line. This keeps the Unallocated balance in line with the other envelopes and accounts as per normal usage of GB. The only trick is that last envelope transfer labeled CC Paydown has be calculated by the user to bring the CC Holding balance back in line with the Credit Card account immediately after making the payment.