My “IRA” envelopes got me thinking lately. The are monthly, but the amount I put in them each month is irregular, depending on what my other envelopes are doing in a particular month. During any given month I might allocate and spend 500 or 1000 or zero or anything else. For this reason they are set to $0 and end each month at $0. This is fine for monthly budgeting purposes, but because of the nature of IRA investing, there is a max amount per year that I can cycle through these envelopes, and I have to keep track of that total in a separate spreadsheet.

This got me thinking about the recent post where someone wanted to track their irregular monthly giving against a set target amount for the year. I believe after some mental gymnastics it was eventually settled on using a debt account to track the “progress” towards the “goal”, but this seems like trying to hack GB to misuse one feature for a completely different purpose.

I feel like we could use a new envelope type, something akin to “Goal” but instead of a balance goal it has an expense goal. I might call it a “Target” envelope. Or, perhaps instead of a new envelope type, an additional feature to existing envelopes where we can optionally specify a Target Amount and a Target Date. For example, I keep my Monthly “IRA” envelope and specify $6000 Target Amount and 12/31/2022 Target Date.

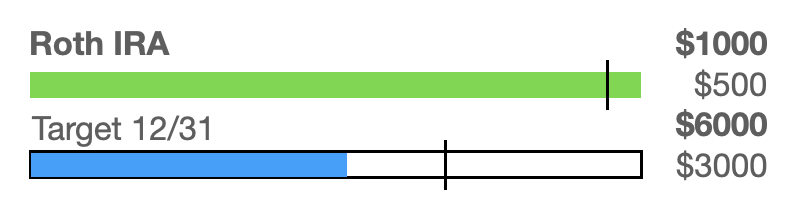

Something like this in the envelope view:

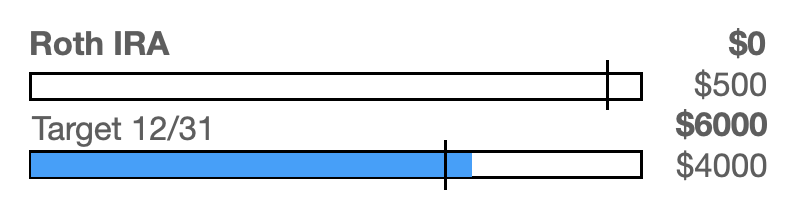

This represents a monthly envelope with a $500 amount into which I’ve allocated $1000 (because I had extra this month). The vertical line on the green bar shows it’s near the end of the budget month. The blue bar shows the target date and target amount, of which I’ve spent $3000 to date. the vertical line shows it is about two thirds of the way to the target date and how far “behind” I am on the spending. Today I decide to send that $1000 to Fidelity and the bars update accordingly:

Thoughts?