Hi - So I charge MOST but not all of my monthly expenses to a visa card, which I pay off each month. Currently I take, for example, the grocery envelope and subtract the remaining balance, and that shows me the amount I should owe on the credit card, plus other envelope charges. Is there a way I can easily see the total due on my credit card, to match it to what my bank says? I pay the credit card balance off completely on the last day of each month, so the next month starts out fresh.

Thanks!

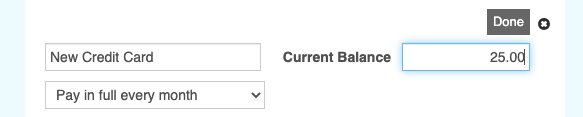

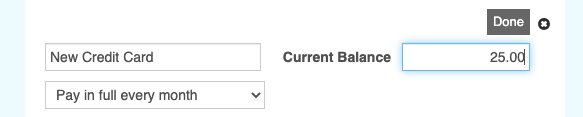

I do the same thing–are you using multiple accounts in Goodbudget? If so, create an account for each of your credit cards and use the Pay In Full Every Month setting. It will look like this on the web:

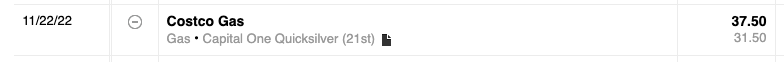

Then fill your envelopes as usual, and each time you make a transaction just charge it to the Credit Card account, like this:

When you make a payment, you’ll do an account transfer from your checking account to your credit card account, which will decrease the balances on both.

Hope that helps!

PS–after doing this for years, I’ve learned something about credit scores (may not apply to you, but if not this may be helpful for someone else)

The US credit bureaus only look at the reported statement balance each month. That means if you charge $5,000, pay it all off, then charge another $5,000 the next month, your payoff won’t help your score since the $5,000 will be reported each time. Not fair IMHO, but that’s how it seems to be calculated.

To “hack” my score I pay off the card just before the statement is processed, so I try to make sure each statement closes with a balance of less than $100. That way no matter how much I’ve actually charged, my debt-to-income ratio remains very low and my card utilization is excellent. I never “carry over” a balance, so there’s no interest accrued, but I always make sure there’s a tiny balance to show the card is in use.

Maybe that hack might help someone who’s working toward improving their credit score!

2 Likes

Oh, perfect. We only carry two credit cards, one that we charge most things on, and then a backup card in case something happens to the main account or card. Incidentally the backup card is a Verizon Wireless Visa card which we have our phone bill charged to, which get’s us a $40 discount per month. Should I create an account for that card as well as well? I have an envelope for Verizon Wireless which I prefill every month.

My advice would be to create an account for any expenses that come out of envelopes. Since the accounts and envelopes represent the same money but from different perspectives, having an envelope with no source to fill it could make things a little off.

It won’t make a big difference in your overall accounting since you’re paying the card off every month from your checking (?) account, but if you record the Verizon bill from checking right off the bat, the checking account balance will be off by that much until you pay the card off again.

I actively track 22 different accounts (eleven checking/savings/cash, eight credit cards that don’t carry balances, and three debt accounts) and although that sounds like a lot it’s made really easy through Goodbudget!

That was my thinking as well. Thanks again!

I’m just getting started and am really confused by the way Credit card expenses are tracked. It seems you have quite a lot ot experience and may be able to offer some clarification!

The individual expenses that are charged to my card will apply to the envelope based on the nature of the charge, groceries, gas, etc. I created a credit card account for which I entered the month end balance. We pay the card in full each statement. When I enter all of my information and balances, my “available” funds are showing my checking balances less the credit card month end balance. This does not seem right. Now, I do not have enough to fill my envelopes based on what GB says is available despite the fact that I have enough in my checking to cover for all expenses with plenty left over.

Appreciate any guidance you can provide.

I think by entering the month-end balance you’re sort of double counting, that is, those expenses are from last month but you’re holding them in this month’s budget to be paid. Will you use income you receive later this month to pay off the current balance? If so, I wouldn’t worry about it too much because it will “right itself” when you get paid. If not, then an easier way might be to start when the card has a zero balance and go forward from there. It won’t be perfect in the first month but it should be ok from then on.

In order to fill all your envelopes at the start of the month/budget period, you need to have that full month’s cushion in your account so all your income is going toward the next month. It sounds like you might have that, or close to it, so counting the prior month’s expenses may be what’s tipping you over the edge.

I’m sorry that’s not clearer, but does it make sense at all?