Hi Tiffany, thanks for the information! I think where I was getting caught up was in the fact that creating an envelope does not automatically fill it, which was a behavior I was expecting.

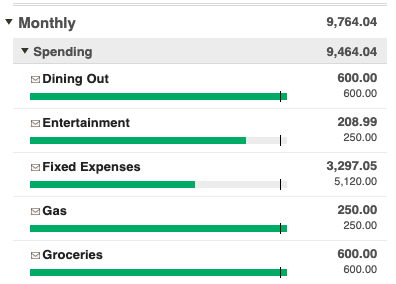

I do have another question for you, and this could be ignorance on my part on how the basis of the system (envelope) works. I filled our envelopes on the first day I started using the app, set our budget, filled them, and set the cadence for when the envelopes would refill (for me, this is the 15th and the 30/31st [last day of the month]). Unfortunately, we still had some ‘bad’ spending habits carrying over from the week that we weren’t using the app, but I wanted to log everything so we understood where we were and where we want to be. This resulted in us having MANY of our envelopes overspent (but even so, made us more aware as we moved towards our new budging system). I expected that on the 15th, the math would clear out and we’d start fresh; however, I logged into the app this morning and it looks like it bases the amount in the envelope not on clearing out behavior from the previous period and refilling, but by applying the math to the previous behavior and leaving you with what’s left.

While I understand where this is coming from (I figure the app is assuming I’m ‘borrowing’ from the future), I feel like the lack of functions to control this is going to make it unusable for me. For us, and I assume a lot of other people like me, we want a method to keep us honest in how we’re spending in a pay period, but that number is still fluid. If I’ve overspent my personal budget for the month, I simply pay out the difference from my personal savings (same with my husband). If we have a purchase to make that would ruin our budget (for e.g.; this last week our fridge broke and we had to purchase a new one), we decide how to divide the payment up and pay it off immediately from the shared credit card it went on, effectively wiping it from ‘spending behavior’.

I appreciate how the app wants to be smart for me, but to keep me as a user I need a function I can choose to say “at the end of the month, tare to 0 and refill the envelopes”. When I think conceptually about an envelope, it CAN’T exist in the negative—I can’t spend what’s not there. But the app let’s me do that, and then carries that over into the new month as though I haven’t done something on my end to bring everything to 0 before I get paid again. Does that make sense?

Right now, to make the application work for me, I will need to delete ALL the transactions every month so that my math gets back to 0, regardless of my spending during the previous period, because for me (and I’m assuming other people that don’t live paycheck-to-paycheck), every month I get the same amount of $$ to use. I literally just want to use this to track down spending in a visual way to keep me honest, and to open a channel of communication for how me and my husband want to handle overages when they happen (as in the past, we’ve simply shrugged and paid, which we have the ability to do, but was dramatically impacting our ability to save, which is our goal now and with using the app). As someone with ADHD, having the history over a 2-week period of time, bucketed out, is a game-changer because it gives me an immediate view on my spending, and helps curb my impulsive behavior when I can see where I stand and where I want to go. I have online banking, but the interfaces on those applications (major banks and lending services) don’t do a good job of bucketing my spending, and leaves me with having to constantly do math to understand where I am in a cycle, which is just a high enough barrier for entry that I will stop doing it and fall back into bad spending habits. So you can see how something like this is really helpful, but still introduces a layer of complication that seems, from my POV, like it should be toggle-able…unless you only want this application to work for people that have very strict budgets with no wiggle room.

I’m not sure if you work for GoodBudget or if you’re just a power user, but I’d love if the developers would consider someone like me as a persona, because the app is so close to being the place where we would monitor all our spending, but the level of manual work I need to do to ‘hack’ it right now (when simply creating a setting that makes each period exist in isolation of the others) would be exactly what I needed. Thanks!