I am new to Goodbudget so there are several thing I cannot get my head around. I do a lot of shopping on line using a cash card that I pay off every month. Groceries, medication, utilities… all are paid through that card. So, I go to the credit card tab and enter the info but there is no place to enter the envelope it comes from. What I don’t understand is how that money is assigned to an envelope. My head hurts trying to figure that out. Do I have to enter that info twice? An increase to credit card and a decrease from that envelop? Since I am trying to pay it from the credit card, it again tell me it is a credit card transaction. Can anyone give me a step-by-step guide as to what I need to do?

Fortunately, this is an easy one! If you pay off your card every month, then don’t set it up as a debt account. You can choose the payoff option from the account characteristics when you build a credit card, and if you don’t carry a balance you’ll use it just like a cash balance. When you pay off or refill the card, you’ll just do an account transfer from the checking (or whichever primary account) to the card and it will break even.

The debt accounts are really only helpful if you’re accruing interest while paying down a debt, but with a monthly payoff you won’t need to worry about that.

Hope this helps!

@tiffany - I have this same question, I do pay off my credit card every month, so are you saying I shouldn’t even put my credit card as an account at all? What happens if I did already? I really didn’t understand your answer. I’m really sorry. Can you give a step-by-step answer or lead me to a video that would do that? That you so much. I think it’s because I am not familiar with a lot of the GoodBudget language yet.

No worries! And no, I’m sorry if it sounded like I meant not to add it as an account; I just meant not to use it as a debt account. When you create a new credit card (and I’m doing this on the web because I think it’s easier than on mobile), you’ll be asked to choose “Pay in Full Every Month” or “Working to Pay Off”. Choosing the Pay in Full option means you’ll be able to just buy things in your envelopes with the card as if it were cash. So, step by step:

+From the main page, switch from the Envelopes tab to the Accounts tab

+Click the “Add/Edit” button near the top of the column

+Click “Add” under the Credit Cards section

+Choose “Pay in Full” from the drop down list (if you’ve already added one as a “working to pay off”, just choose “Edit” and you can change it)

Now when you add a new transaction, you can choose both the envelope and the account (the credit card).

To pay off the card, do an Account Transfer from your checking account to your Credit Card account, and it will adjust the balances of each. Even though the numbers are positive, Goodbudget recognizes that a Checking balance is money you have and a Credit Card balance is money you owe.

Does that help? I’ll see if I can find a video and I’ll edit this comment if I do!

This might help a little: What's the difference between a credit card account and a debt account? | Goodbudget

This might also help, and includes mobile instructions: Step 2. Add Your Accounts | Goodbudget

Thank you so much. That explanation really helped. I actually realized that I had my credit card set up that way. However, I think what I’m doing wrong is putting my grocery charges under groceries and also on my credit card? I’m confused as to how get the correct funds from my envelopes and also make sure they get to the credit card?

Also, is there a way for the full amount to pay off the credit card to automatically come from the checking account or does that have to be manually entered each month?

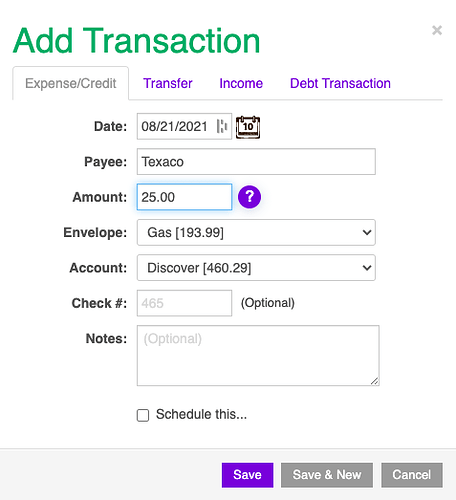

Once your credit card is set up as a “Pay in Full”, you’ll make a single transaction that includes both the envelope and the credit card, like this:

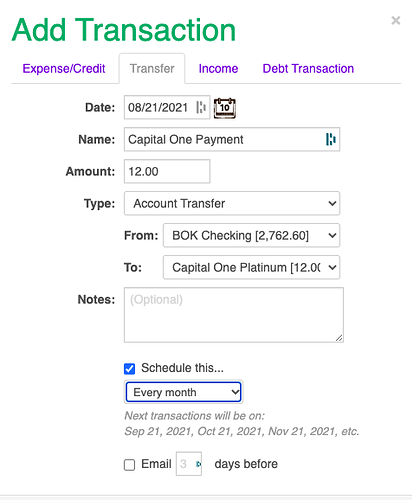

Unfortunately, you can’t set up Goodbudget to assume you’ve paid off the card each month but what you CAN do is schedule a monthly account transfer that will drop into your ledger. You’ll have to adjust the amount manually but the rest of the information will already be filled in.

See if this makes any sense.

- I create a “Cash” account and make an initial transfer from Check to the Cash account in an amount that I expect to use on my card plus a payoff amount (If I anticipate spending 200, I will pay that plus 600 making the total budget for that envelope 800. What I am actually doing is paying 800.00 to that card.

- I no longer include the card as an envelope. In fact, I delete it.

- Use money from the Cash account that I have actually paid with my credit card. Ex: I spent 100 in groceries + finance charge, and “pay” these with monies from the Cash envelope.

- I use a debit card for which in the past I used my credit card.

Since I am actually pay off every charge plus debt retirement, well, there really is no difference.

This process will mean I can no longer trust what GB says is in my Checking Account but I can trust what it says I have spent from each account. What do you think? Any holes in this plan? Is this what you are talking about?

I think I misunderstood you—you’re not paying off the ENTIRE balance each month, just the new charges plus a big chunk toward the existing balance, right?

I THINK your way would work (I’ll have to mull over it some more) but I also THINK I have an easier way. Two, maybe…

The two options: I had this situation and I created two accounts—a debt account for the balance I was paying off, and a “pay in full” for the new charges. That worked but it’s a little hard to manage two “balances” on one real card.

An easier way, that keeps your checking account accurate, might be to create a regular account (not a credit card) with a NEGATIVE balance equal to the amount you owe. Each purchase from that account will cause it to go more negative (because you’ll owe more) and then you can transfer money from checking to the card when you pay it, bringing the balance closer to zero. You’ll have to use your statement to determine your new charges and add a transaction for interest and fees (your payment will be new charges plus fees, plus the $600) but you can still manage your money in Goodbudget. You may even want to schedule the $600 transfer/payment so it will show as pending in your ledger.

Long-winded, but hopefully helpful?

Thanks. The second option does sound like it will work. I will try it.

I have tested your suggestion #2. It works for keeping my Checking account accurate be my unallocated!!! Way off. I will try #1

Ah yes, I knew I was forgetting something.

The first way worked well for us but reconciling does take a bit of extra math—it’s a clunky process.

Since from now on, I will be paying with a debit card that takes money directly from my checking account, I will no longer have any additions to the CC… exception for interest . It is just a matter of having an envelop with a budget of $600. The other items will be paid directly from my checking. I might not follow the cc balance that well but certainly do check it once a month. So that should not be an issue. No need for a new GB Account, just a new envelop for the $600 payoff

I guess the thing that is confusing me is say I bought groceries on my credit card. I don’t understand if I should use money from my groceries envelope to pay my credit card. It doesn’t allow me to split the payment of the credit card into more than 2, so that is confusing. I couldn’t even just say that I was paying the CC from just my checking account. So I’m not sure how to do it. I read that other people are making a “cash” account somehow to make up for this but I don’t really undersatnd that at all. Is there an easier way to take care of this so I’m not double-dipping to pay for these transactions

Are you paying the entire new balance each month plus some of the revolving balance?

I’m paying the entire balance, so there’s no revolving balance

Ah, ok!—in that case you don’t need to budget for the credit card payment at all because each transaction will be from an envelope and will go against the credit card balance. Just be sure the card is set up to Pay in Full, then your transaction will show the envelope and the card/account.

Your available funds are calculated by adding your bank account balances and subtracting the amount due on your “pay in full” credit cards. This is how much you can put into your envelopes. (Long term debts like loans and revolving charges aren’t calculated against your funds on hand)

When you pay the bill, you’ll simply do an Account Transfer from your checking account to your credit card but no envelopes will be involved in the payment. It won’t change your available money because the checking balance goes down but the credit debt is relieved at the same time.

I hope this is helpful—it sounds convoluted but it’s really pretty elegant in practice!

I got my debit card since we last communicated. Having it is much like writing checks; money comes directly from my checking account rather than through a credit card. I just register my credit card payments by way of two envelopes: one for the principle and one for the interest. I love GB now!