I am new to using GB to track my credit card expenses - I have only used it for our checking account previously.

When I import my list of credit card transactions, I assign them to the correct account and envelope. I pay my card off every month, so I understand that when I make the payment I just transfer the amount from my checking account to my credit card amount. But I’m not sure what to do about the payments when they appear in the list as I import transactions. How would I assign them without it seeming like a credit that I don’t actually have?

Hopefully this makes sense!

Personally I’d just ignore them in the Credit Card Account (i.e. not import them). If you already have them in Goodbudget as Account Transfers, then putting in another transaction would just count it double and make things confusing.

Alternatively, if you haven’t put in the Account Transfers yet, you can add the payments as Credits to your Credit Card Account and then use them as reminders to create Transfers, and delete the Credits once you’ve done that.

I cannot figure out how to make payments to credit cards and it’s frustrating I’ll get a refund and go back to a manual budget. I allocate expenses when using credit cards, but how do I transfer from my Checking account to a credit card in your system? It doesn’t give me the option of Checking in my drop-down even though there is a checking account. Do I just use unallocated (seems not)?

It sounds like you may be struggling with the difference between accounts and envelopes. The credit card and checking should be two separate accounts, so a payment simply represents a transfer from checking to the CC. Depending on whether you pay the card off every month or carry a balance (a debt account), the transaction may have some additional data but the general principle is the same.

On the envelope side you won’t be “making payments”, nor will you have a “checking account” unless you’ve created an additional envelope for that (which would be unusual). You’ll just have the expenses you’ve made. “Unallocated” is simply a representation of the combined balance of all your non-credit/debt accounts, minus the amounts you’ve designated to the envelopes you’re using.

It can get confusing if you’re using a card while you try to pay off a balance; you can enter transactions as debts but without some creative usage those charges won’t come out of the “correct” budget envelope, e.g. a Grocery purchase will show as a debt, but won’t deduct from your grocery envelope.

Bottom line: to make a credit card payment, do an account transfer from Checking to the Credit Card if it’s a card you pay off monthly, or do a Debt Transaction/Payment if it’s a card you’re working to pay off.

Is that helpful?

Last try, How do I transfer from Checking to Credit card? Checking is not an option under my “from accounts” nor do the credit cards I pay off come under debt accounts. Is there a better solution/package you would recommend as your package just isn’t working for me? Sorry

It sounds as if maybe your accounts and envelopes aren’t set up correctly? Do you have all your budget envelopes in one tab, and all your accounts in another? Or are you confusing the debt envelope for the credit card with its actual account maybe?

I found the option to make the payment on my credit card a transfer when it came in to be confirmed. There is a drop down menu that said something like, income, transfer, expense. I’m not. Great at this, but that was easy.

Then, I got a transaction where the predicated payment wanted an envelope. Since I already made it a transfer and it was accounted for, I deleted that per instructions from this forum and it all worked out,

I’m determined to understand how this all works and make it work for me.

That said, it can be frustrating! I’m not a fan of learning curves.

@Cynthia_Dodick Sorry for the frustration, but I think you’re crushing this learning curve!

In case this helps, you’re using Bank Sync and have linked both your Checking Account and your Credit Card Account. As a result, your real-life credit card payment shows up in Goodbudget twice. I know that’s confusing, but you did everything correctly! You converted one of those synced transactions into an Account Transfer, and then deleted the other (so as not to have your payment recorded twice). Nice work!

Hello, I am a new user in the San Antonio area. I need help getting up to speed on how to use this program. Would anyone be interested in a coaching role for a few days to help me get out of the ditch? Getting paid is not out of the question. I want help quick. Avery Murrah 210-900-9505

Hiya—I’ve done Zoom coaching for a few other users in the past, but never for pay and only with the understanding that I’m not affiliated with the Goodbudget team, just an experienced long-time user! (Un)fortunately I’m on vacation through Sunday though, so it would have to be next week and that may not be soon enough for you. If that does work, let me know and I’d be happy to set something up. (I use the web and iOS versions pretty fluently, but don’t have direct experience with Android specifically or the new auto-import feature). Happy to help!

Ok so I am new to Goodbudget. I used another app called Mvelopes for several years which was a great budgeting app for us. Goodbudget has some of the same features so I am hoping this will work for us. I am reaching out to see if anyone has a link to video tutorials outlining options of how to handle credit card payments and transactions. Overall this application is working well. Managing the credit card payments and transactions seems the most confusing with this application. I have searched youtube but no success in finding anything useful regarding credit card payment and transactions.

Current setup

- We have our checking account and credit card setup as a linked account.

- We pay off our credit card every month.

I have read through the post but nothing seems to be connecting with me I am a visual learning so a screen capture or video would be great. Thank you!

I am a visual learning so a screen capture or video would be great. Thank you!

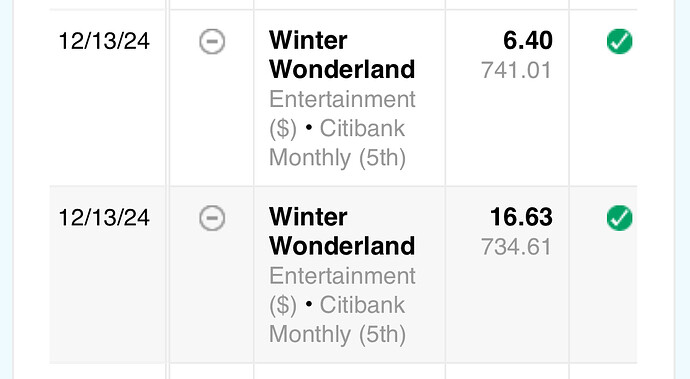

If you pay off your credit cards each month, the process should be super simple. Just be sure the cards aren’t set up as “carrying a balance” (you can toggle between the options when you establish them) and then you can use them as your funding source for each transaction. For example, if you have 100.00 in a Grocery envelope and you spend 25.00 at the grocery store, just enter a transaction with the credit card as the correct account, like this:

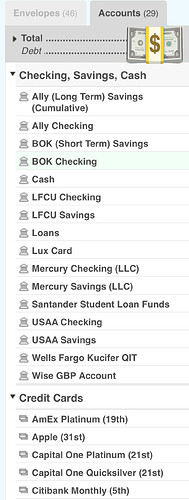

BTW, your account list should look like this (probably with fewer accounts, lol):

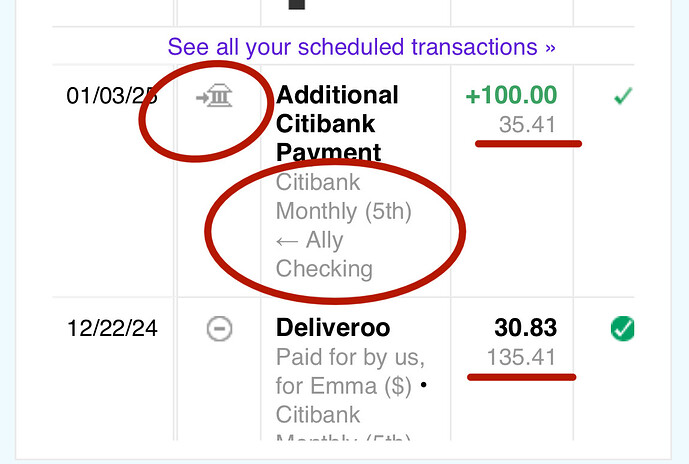

This will increase your credit card balance and decrease your envelope balance. When you pay off the card, just do an Account Transfer from checking (or wherever) to the card and you’ll be all set. That transaction will look like this:

Notice that unlike a deposit in a “regular” account, a transfer to a credit card reduces the balance since Goodbudget knows it’s paying off a debt.

Can I ask why the correct action is to have to delete a transaction? This continues to be a problem any time I transfer funds between accounts and the inability for this tool to recognize and pair identical transactions is absolutely infuriating. On a good month, I have to delete a transaction monthly…

Something else that also extremely frustrating is how permanent transaction editing actions are… I can’t count how many times I’ve incorrectly set a transaction as a transfer, found out it incorrectly skewed my account balances, only to realize I can’t go back and change the transaction type. IMO, I should always be able to change the transaction type if needed, especially since GB didn’t identify these transactions as a specific type from get go.

It can’t be that hard to add a function link or merge transactions in order to confirm all transactions without risking duplicity.

I really like how effective GB has been on my budgeting, but if “permanent transactions” and “just delete it” don’t get resolved, I’ll be looking at other tools when it’s time to renew.

Thanks for your post. The correct action right now is to delete the second transaction because there currently is not a match function. If you don’t delete the second transaction, then you’ll have a duplicate.

If you look at our Roadmap, you’ll see that we’re actively working on a potential match feature. We don’t have a timeline on when it might be released, however.

In terms of the ability to switch types for transactions that have already been confirmed, that’s not something we’re working on.

We certainly hope you’ll stick around, but we also want you to find a product that works best for you needs long-term. Hope this helps.