I made a payment of $25 from my checking account to one of my credit cards. The payment shows the breakdown of Principal: $13.26 and Interest: 11.74. The checking account shows the payment as $25. The credit card side is showing only the Principal: $13.26 as a plus. When I go to reconcile the credit card only the $13.26 shows as needing to be cleared. The register for the checking account shows the $25. The register for the credit card for the same transaction shows +$13.26.

It sounds like you’ve set up the card as a debt, instead of a credit card with a running balance. A CC account should credit the entire payment to the outstanding balance, but you will have to add the monthly interest in as a transaction.

Is that possibly what happened?

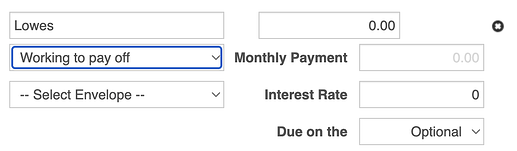

Yes that is what happened. I have other credit cards I have entered as debts because I checked the working to pay off selection. Is there any easy way to change them to credit cards?

You may have things correct already, if you’ve entered them as credit cards instead of regular debt accounts. Does your Accounts > Edit list look like this?

(To be fair, I’ve never carried an interest-bearing balance on a Goodbudget credit card so I haven’t seen this directly, but what you’re describing seems odd–is the interest automatically generating a second transaction to be cleared?)

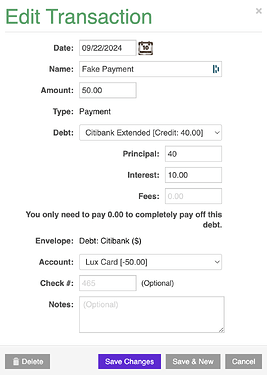

Oh, wait, are you using Bank Sync? That’s apparently not working with debt accounts yet and you might have to enter the interest manually. I just did a fake transaction on an old debt credit card account and it showed up like you expected; $50 out of the payment account and $50 into the credit card, with the interest only showing up inside the transaction once I clicked on it.